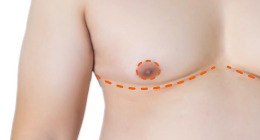

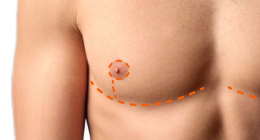

Top Surgery Insurance Tips From a Super Mom Who Won't Take 'No' For An Answer!

While more and more insurance companies in the United States are covering Top Surgery for transgender and gender-nonconforming individuals, navigating the world of insurance remains daunting. Thankfully, there are people who can help!

Kathie Moehlig is a parent advocate and the founder of Trans Family SOS. Through the San Diego-based organization, Kathie works tirelessly to provide trans youth and their families assistance with health care and insurance, school policies and legal issues. But Kathie doesn't just offer helpful information; this Super Mom sinks her teeth in and puts insurance companies up against the rails! Case in point: of all the families she has provided insurance guidance for, not one has lost an appeal. Kathie was kind enough to take the time to share some of her top tips with us for getting insurance coverage for Top Surgery.

Kathie Moehlig is a parent advocate and the founder of Trans Family SOS. Through the San Diego-based organization, Kathie works tirelessly to provide trans youth and their families assistance with health care and insurance, school policies and legal issues. But Kathie doesn't just offer helpful information; this Super Mom sinks her teeth in and puts insurance companies up against the rails! Case in point: of all the families she has provided insurance guidance for, not one has lost an appeal. Kathie was kind enough to take the time to share some of her top tips with us for getting insurance coverage for Top Surgery.

Find Out If You Have Insurance Coverage

How do I know if I'm covered by my employer's insurance plan?

KM: "Your first step is to identify what is covered (or not covered) in your insurance plan. Get the most up-to-date version of your plan's Certificate of Coverage and locate the exclusions and limitations section. Look for anything related to transgender, gender, sex change, etc. If there are exclusions, don't give up! There may be ways around this."

If there are no exclusions, you can proceed with meeting insurance criteria, finding a surgeon who takes insurance (either as an in-network provider or on a single case agreement with your insurance company), and getting a pre-authorization for coverage.

Meeting Insurance Criteria

Insurance companies have criteria that you will need to meet to be approved for coverage. The criteria can vary slightly between plans and may include: a minimum age of 18, a diagnosis of Gender Dysphoria, and 12 months of hormone therapy. All insurance companies will require confirmation of the medical necessity of your surgery.

How important is it to meet all of the required criteria in the insurance plan?

KM: "It's very important to meet insurance criteria, however it's also true that medical necessity can override other criteria set out by an insurance policy. For example, Trans Family SOS has provided guidance in multiple cases where the subject was a minor, and every one of those appeals was successful, based in part on the strength of the documentation proving medical necessity."

Appealing An Insurance Denial

What can I do if I receive a denial from my insurance company?

KM: "Denials are common so you can expect at least one. Don't get discouraged! Instead, get to work on your appeal application. Read the denial letter carefully to determine the reason for denial and what your appeal will need to address. In your appeal package, include additional letters from medical doctors that expand on the immediate medical need for surgery. I also recommend including a photo of yourself; it helps humanize your application in the eyes of the reviewer(s)."

Final Tips

1. Don't take "No" for an answer! You may need to file more than one appeal.

2. Don't forfeit your right to appeal. Pay close attention to appeal deadlines.

3. Don't go it alone; get help: Contact Trans Family SOS

For more information and tips about getting your Top Surgery covered by insurance, see:

- How-To Guide: Insurance Coverage for FTM Top Surgery In the United States

This guide was authored by a non-binary individual who is not on Testosterone, lives in state that had no legal protections, and had an insurance plan with exclusions—and they still got their Top Surgery covered! Now they're sharing how they did it with anyone who can benefit! Includes appeal letter templates. - FTM Top Surgery Insurance Coverage: What You Need to Know

- Surgeons Who Accept Insurance for FTM Top Surgery

- Lambda Legal's Accessing Coverage for Transition-Related Health Care

- Transgender Law Center's How to Appeal Your Health Care Denial [In California]

- Considerations for transgender people navigating the Health Insurance Marketplace.

Last updated: 03/15/23